DOGE Price Prediction: Can the Memecoin Overcome Resistance and Reach $1?

#DOGE

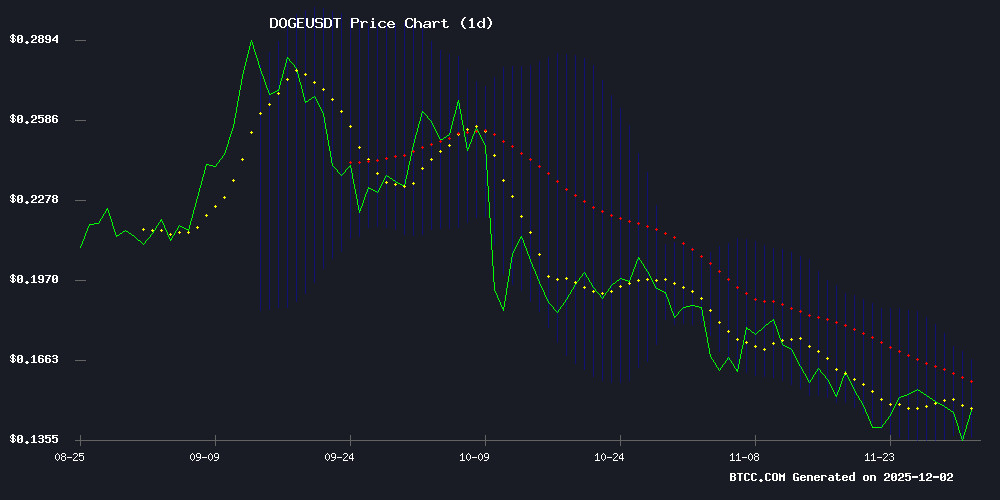

- Technical Resistance: DOGE faces immediate hurdles at its 20-day MA and Bollinger Bands, needing to break above $0.166 to signal any short-term bullish reversal.

- Market Sentiment: Current news flow highlights broken support and low whale activity, creating a cautious to negative sentiment that must improve for sustained upward momentum.

- Price Target Feasibility: A move to $1 requires a nearly 588% surge, which is unrealistic under current technical and fundamental conditions without a massive shift in crypto market dynamics.

DOGE Price Prediction

Technical Analysis: DOGE Shows Oversold Conditions Amid Bearish Pressure

According to BTCC financial analyst Michael, DOGE is currently trading at $0.14536, below its 20-day moving average of $0.151187, indicating short-term bearish momentum. The MACD histogram reading of -0.001322 suggests weakening bullish momentum, though the signal line at 0.009866 remains above the MACD line at 0.008544. The price sits NEAR the lower Bollinger Band at $0.136086, which may act as immediate support, while the middle band at $0.151187 and upper band at $0.166287 represent resistance levels. Michael notes that the proximity to the lower band could signal oversold conditions, potentially setting the stage for a technical rebound if buying pressure emerges.

Market Sentiment: DOGE Faces Headwinds Amid Support Breaches and Whale Inactivity

BTCC financial analyst Michael observes that recent headlines highlight a challenging environment for Dogecoin. The breach of key support levels and reported decline in whale activity suggest diminished large-investor confidence, which typically fuels volatility and rallies. While articles mention potential 'bullish rebounds' and 'Fibonacci targets,' the prevailing narrative emphasizes downside risks, including 'swing lows' and dried-up whale movements. Michael cautions that until whale activity resumes or solid support is reclaimed, sentiment is likely to remain cautious, aligning with the technical picture of near-term pressure.

Factors Influencing DOGE’s Price

Dogecoin Rebounds from Swing Lows: Fib Targets in Focus

Dogecoin (DOGE) shows resilience, testing key resistance levels amid a bullish MACD crossover. The meme coin trades at $0.138, up 1.79% in 24 hours, as traders eye Fibonacci retracement ceilings for potential breakout opportunities.

Technical indicators suggest accumulation, with the moving average convergence divergence (MACD) flashing a buy signal. The rebound follows a period of consolidation, mirroring broader crypto market sentiment.

Dogecoin (DOGE) Price Slips Below Support: Is a Bullish Rebound Still on the Table?

Dogecoin has once again breached a critical support level, casting doubt on the sustainability of its recent bullish momentum. The meme cryptocurrency's decline mirrors broader weakness in altcoins, with buyers failing to establish higher lows across the market.

Technical indicators paint a concerning picture. DOGE's chart shows a series of lower highs, signaling persistent selling pressure. Trading volume at support levels has diminished, suggesting waning conviction among bulls. Whale activity, often a precursor to major moves, remains subdued.

The next 24 hours could prove decisive. Historical data shows Dogecoin has rebounded sharply from current levels in the past, but current market conditions appear less favorable. Without strong buyer intervention, DOGE risks confirming a deeper correction phase.

Dogecoin Breaches Key Support as Whale Activity Dries Up

Dogecoin's price collapsed below the psychologically significant $0.15 level, tumbling 10% to $0.13 amid broad crypto market weakness. The meme coin now tests critical support at $0.14 as trading volumes evaporate.

Whale transactions exceeding $1 million have plummeted from 38 to just 4 daily - a 60-day low that signals eroding institutional interest. This liquidity drought coincides with Bitcoin's breakdown below $60,000, which triggered cascading liquidations across altcoins.

Technical indicators flash contradictory signals. The RSI at 20 suggests oversold conditions, while the MACD maintains its bearish cross. A developing Cup and Handle pattern hints at potential recovery, but only if DOGE can reclaim $0.15 resistance.

Market makers appear to be eyeing $0.12 and $0.10 as next downside targets. The coin trades 31.5% below its 200-day EMA - a level that historically required 40% discounts before sustaining rallies.

Will DOGE Price Hit 1?

Based on current technical and sentiment analysis from BTCC financial analyst Michael, DOGE reaching $1 in the near term appears highly improbable. The price would need to increase by approximately 588% from its current level of $0.14536, requiring a monumental shift in market dynamics.

Key hurdles include:

| Resistance Level | Price (USDT) | Significance |

|---|---|---|

| 20-Day MA | 0.151187 | Immediate technical resistance |

| Bollinger Middle Band | 0.151187 | Dynamic resistance & trend indicator |

| Bollinger Upper Band | 0.166287 | Near-term volatility ceiling |

| Psychological Round Number | 0.200000 | Key psychological barrier |

Michael emphasizes that for DOGE to embark on any sustained rally toward higher targets, it must first reclaim and hold above the $0.151–$0.166 resistance zone. Furthermore, a resurgence in whale activity and overwhelmingly positive market sentiment—neither of which are currently present—would be essential catalysts for any move approaching $1. While not impossible in a long-term, speculative crypto bull market, the present evidence does not support a realistic path to $1 in the foreseeable future.